Mutual Fund Average AUM Rises 3.6% in Oct-Dec 2024, Ends 2024 with a Spectacular 39% Growth!

Mutual Funds on the Rise: Despite market corrections in the October-December quarter, the average AUM rose by 3.6% to ₹68.62 Lakh Cr. The mutual fund industry posted an impressive 39.39% growth in 2024, powered by record SIP inflows and a surge in New Fund Offers(NFOs).

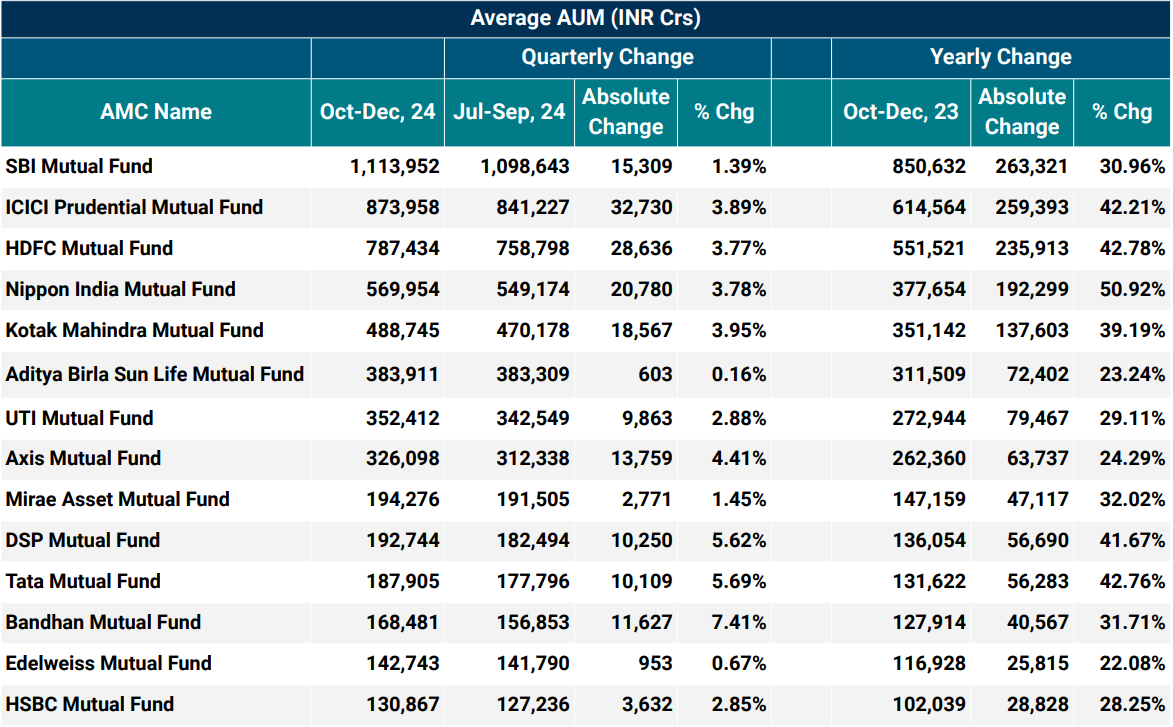

SBI MF AAUM Crosses ₹11 Lakh Cr : SBI Mutual Fund's Average Assets Under Management (AAUM) reached a new milestone, crossing ₹11 lakh crore in the last quarter. Strengthening its industry leadership, the fund house has retained its top position for the 20th consecutive quarter, reflecting unwavering investor trust and sustained excellence.

Mutual Fund Rankings Remain Unshaken: The mutual fund landscape showcases remarkable stability, with the top eight and top three firms holding their ranks for 14 consecutive quarters. Notably, the top 10 Asset Management Companies (AMCs) have retained their positions, underscoring a period of consistent dominance within the industry.

ICICI Mutual Fund Leads Absolute Growth: In the latest quarter, ICICI Mutual Fund emerged as the top gainer in absolute average AUM growth, followed by HDFC and Nippon India Mutual Fund. This surge highlights the fierce competition and dynamic growth fueling the mutual fund industry.

Rising Stars in Mutual Funds: Invesco, Groww, Old Bridge, Helios, JM Financial and Navi Mutual Fund have climbed the mutual fund rankings, showcasing significant progress over previous quarters.

Top 10 AMCs Drive Industry Growth: The top 10 Asset Management Companies (AMCs) have been instrumental in the mutual fund industry's stellar performance, accounting for a remarkable 77% of the Average AUM growth this past quarter.

Top Percentage Growth Performer: In the last quarter, Motilal Oswal, Old Bridge, Groww, Zerodha and Helios Mutual Funds recorded impressive percentage growth in Average AUM, marking remarkable progress compared to previous quarters.

Quant Mutual Fund Sees AAUM Decline: Quant Mutual Fund stands out as the only fund to report a decline in Average AUM during the last quarter.

For a comprehensive understanding and more insights, please go through our detailed report.