Double Trouble: FPIs Selloff Hits Record Levels in Equity, Reverses Trend in Debt

Highest FPI Outflows in Indian Equity Market History

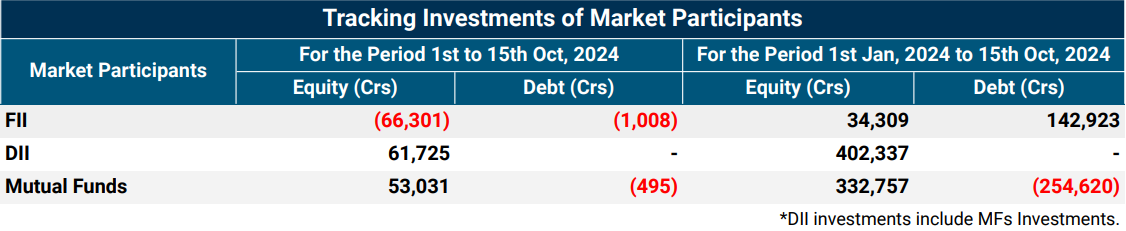

Foreign Portfolio Investors (FPIs) have pulled out a record ₹66,301 Crs from the Indian equity market in the first half of this month, marking the highest outflow ever in Indian history.

FPIs offloaded Indian stocks for 10 consecutive trading days in early October, with the highest single day selloff of ₹15,506 Crs on October 3rd.

The current outflow surpasses the previous record of ₹61,973 Crs set in March 2020 during the onset of the pandemic, according to NSDL data.

This massive sell-off comes as global factors like a surge in Chinese stocks, heightened tensions in the Middle East and relatively high valuations of Indian equities drive FIIs to exit.

FPI Turnaround: Indian Debt Market Sees First Net Outflow Since April

Foreign Portfolio Investors (FPIs) recorded the first net outflow from the Indian debt market since April, selling ₹1,008 Crs worth of investments in the first half of October.

This selling pressure further pushed down their total investments in the debt segment, reducing the cumulative inflows for the calendar year to ₹142,923 Crs.

Record DII Buying Cushions FPI Selloff in October

Domestic Institutional Investors (DIIs) have stepped up in 2024, providing much-needed support to the Indian markets amid heavy selling by Foreign Portfolio Investors (FPIs).

So far this year, DIIs have net bought over ₹4 trillion, setting a new record for annual inflows. This surpasses the previous high of ₹2.8 trillion in 2022.

In response to the heavy FPI selloff in the first half of October, DIIs stepped in, buying ₹61,725 Crs to stabilize the market and offset the massive foreign outflows.

Mutual Funds Lead the DII Charge with ₹3.32 Trillion Investment in 2024

Mutual Funds (MFs) have been the driving force behind the record-breaking DII inflows in 2024, contributing a staggering ₹3.32 trillion out of the total ₹4 trillion invested by DIIs. Mutual Funds made a significant investment of ₹53,031 Crs in Indian markets in the first half of October.

This marks a significant increase from 2022, when MFs had invested ₹1.86 trillion. The steady inflows from MFs have played a crucial role in cushioning the blow from FPI outflows, underscoring the growing importance of domestic investors in maintaining market stability.

FPI Record Selloff Hits Key Sectors: Financials, Oil & Gas, Auto and More

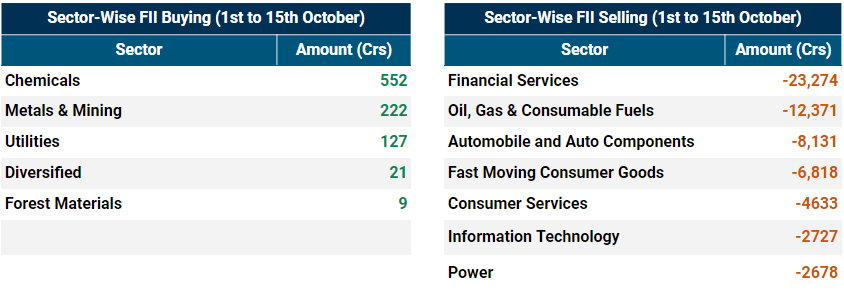

In a massive selloff during the first half of October, FPIs unloaded significant holdings across key sectors including Financial Services, Oil & Gas, Automobile & Auto Components, FMCG, Consumer Services, Information Technology and Power.

This broad-based selling reflects rising global uncertainties and market pressures.

FPIs Limited Bets in Chemicals, Metals

Despite heavy selloffs in other areas, FPIs made minor investments in the Chemicals, Metal & Mining and Utilities sectors during the first half of October, showing selective interest amid broader market turmoil.

FPIs Top Picks in 2024: Telecom, Capital Goods, Healthcare and More

In 2024, FPIs have shown a clear preference for sectors like Telecommunication, Capital Goods, Consumer Services, Healthcare, Realty, Services, Consumer Durables and Chemicals, highlighting their strategic focus on these high-growth industries.

FPI Exit in 2024: Major Selloff in Financials, Oil & Gas, Construction and More

In 2024, FPIs have heavily offloaded their holdings in sectors like Financial Services, Oil & Gas, Construction, FMCG, Power, Construction Materials, Automobile & Auto Components and Media, reflecting a broad exit from these key areas.

For a comprehensive understanding and more insights, please go through our detailed report.