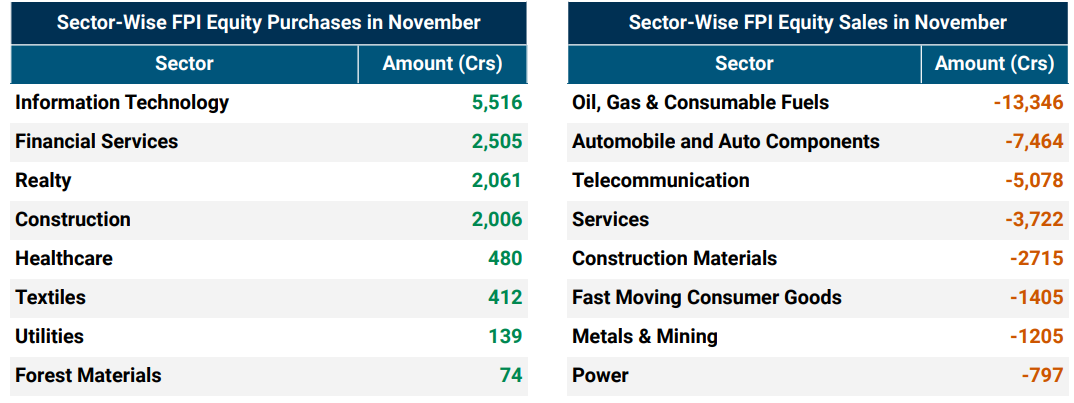

FPIs Bet on IT, Financials and Realty Amid November Selloff

Amid selloffs in November, FPIs made investments in the Information Technology, Financial Services, Realty, Construction, Healthcare, Textiles and Utilities, indicating cautious, sector-specific interest despite broader market challenges.

FPI Record Selloff Hits Key Sectors: Oil & Gas, Auto, Telecom and More

In November, FPIs significantly reduced holdings across crucial sectors like Oil & Gas, Automobile & Auto Components, Telecommunication, Services, Construction Materials, FMCG, Metal & Mining and Power. This widespread selloff underscores rising global uncertainties and intensifying market pressures.

FPIs Turn Net Sellers in 2024 as November Records Slower Selloffs Amid Volatility

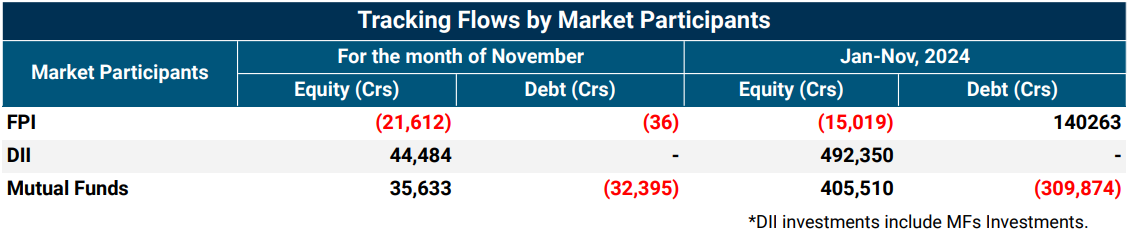

FPIs pulled ₹21,612 Crs from the markets in November, citing expensive valuations and weak Q2 earnings, a notable slowdown compared to October's sharp selloff.

The November selloff pushed FPIs into net selling territory for the calendar year 2024, with total year-to-date selloff amounting to ₹15,019 Crs, reflecting increased market pressures and cautious sentiment.

Despite market weakness in November, FPIs invested ₹17,704 Crs in primary markets and briefly turned buyers, infusing ₹15,829 Crs between November 22-26 before resuming sales.

FPI Muted in Debt Market: November Witnesses Minor Selloff

FPIs sold a modest ₹36 Crs in India's debt market in November 2024, reflecting subdued activity in the segment.

This marginal selloff brought the cumulative debt market investments for the calendar year down to ₹1,40,263 Crs, highlighting reduced foreign interest.

DII Buying Shields Markets from FPI Selloff in November

Domestic Institutional Investors (DIIs) set a record in 2024 with net purchases exceeding ₹4.92 trillion, breaking the ₹2.8 trillion annual investment record from 2022.

In November, DIIs countered heavy FPI selloffs by injecting ₹44,484 Crs, providing stability and cushioning the market against foreign selloffs.

Mutual Funds Drive DII Surge with ₹4.05 Trillion in 2024

Mutual Funds led the charge in record-breaking DII investment, contributing ₹4.05 trillion out of the ₹4.92 trillion total in 2024.

In November, they bolstered the Indian equity markets with an investment of ₹35,633 Crs, cementing their role as a market stabilizer.

For a comprehensive understanding and more insights, please go through our detailed report.