2024 Trend Shift: FPIs Exit Indian Equities as Net Sellers

FPIs Continue to Exit: ₹22,420 Cr Pulled from Indian Equity in November's First Half

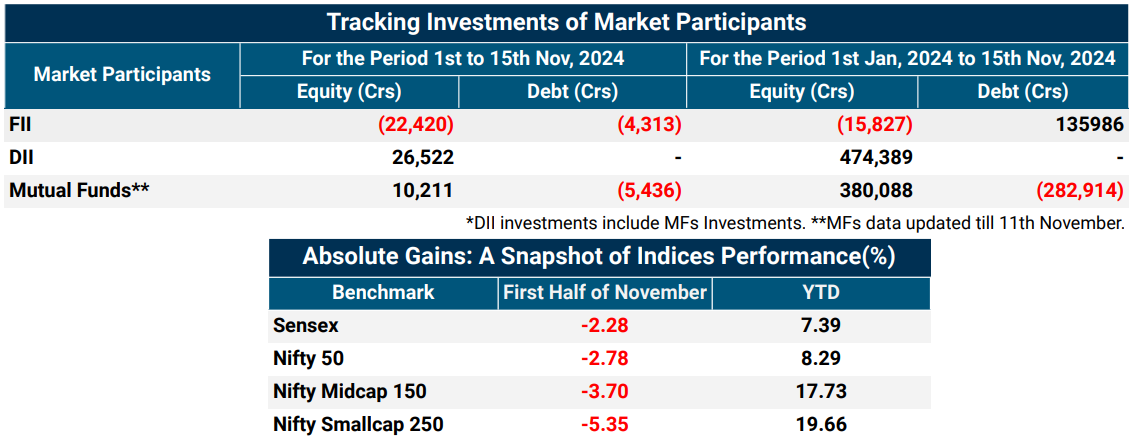

Foreign Portfolio Investors (FPIs) have withdrawn ₹22,420 Cr from the Indian equity market in the first half of November. This marks the second consecutive month of selling, following October's record-breaking selloff—the largest in Indian market history.

FPIs have turned net sellers in the Indian equity market for the calendar year 2024. With a net selloff of ₹15,827 Cr by the end of the first half of November, their investments have swung into negative territory, signaling a cautious stance on Indian equities.

FPIs Selling Persisted in Key Sectors: Financials, Oil & Gas, FMCG, Auto and More

In the first half of November, FPIs maintained their selling spree in Financial Services, Oil & Gas, FMCG and Automobile sectors. The selloff also extended to Telecommunication, Metal & Mining, Services and Capital Goods, emphasizing a focused reduction in holdings.

FPIs Reverse October Selloff, Turn Buyers in IT and Construction Sectors in November

Following widespread selloffs in October, FPIs shifted their stance in the first half of November, turning buyers in Information Technology and Construction sectors, effectively reversing October's trend. FPIs also made significant investments in Healthcare, Realty, Chemicals, Textiles and Media sectors, showcasing renewed confidence in these areas.

FPIs Extend Selloff in Debt Market: ₹4,313 Cr Pulled in November's First Half

FPIs continued their withdrawal streak from the Indian debt market for the second consecutive month, offloading ₹4,313 Cr worth of investments in the first half of November.

This selling pressure further pushed down their total investments in the debt segment, reducing the cumulative inflows for the calendar year to ₹135,986 Crs.

DIIs Set Record with ₹4.7 Trillion Net Buying in 2024, Surpassing 2022 High

Domestic Institutional Investors (DIIs) took charge in the first half of November, investing ₹26,522 Cr to stabilize the market amid relentless FPI selloff.

DIIs have net bought over ₹4.7 trillion so far in 2024, marking a new record for annual inflows. This impressive figure surpasses the previous high of ₹2.8 trillion achieved in 2022, highlighting robust domestic support for the market.

Mutual Funds Propel Record DII Inflows with ₹3.8 Trillion Contribution in 2024

Mutual Funds (MFs) have been the key drivers of record-breaking DII inflows in 2024, contributing a massive ₹3.8 trillion out of the total ₹4.7 trillion invested by DIIs. In November alone, MFs have made notable investments of ₹10,211 Cr in Indian markets as of November 11, showcasing their critical role in market stability.

This marks a significant increase from 2022, when MFs had invested ₹1.86 trillion. The steady inflows from MFs have played a crucial role in cushioning the blow from FPI outflows, underscoring the growing importance of domestic investors in maintaining market stability.

For a comprehensive understanding and more insights, please go through our detailed report.