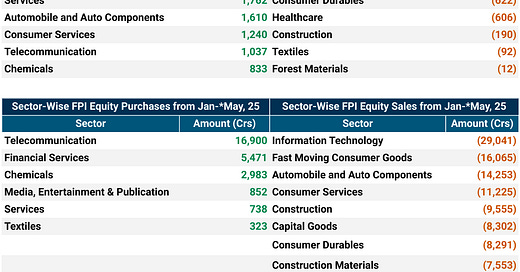

FPI Buying Spree in Early May 2025– Financials, Infra & Energy in Focus

Foreign investors turned selectively positive in early May, infusing over ₹17,570 Cr into Indian equities. The lion’s share went to Financial Services (₹4,728 Cr), followed by strong allocations to Capital Goods (₹2,233 Cr), Oil & Gas (₹2,130 Cr) and Services (₹1,762 Cr).

Auto, Telecom and Chemicals also saw steady inflows, indicating preference for domestic cyclical and infrastructure plays.

FPI Selling in First Half of May 2025 – Defensive & Real Assets Witness Outflows

Despite select inflows, FPIs exited defensives like FMCG (₹1,057 Cr), Healthcare (₹606 Cr) and Consumer Durables (₹622 Cr). Realty and Power too saw selling of ₹842 Cr and ₹720 Cr respectively.

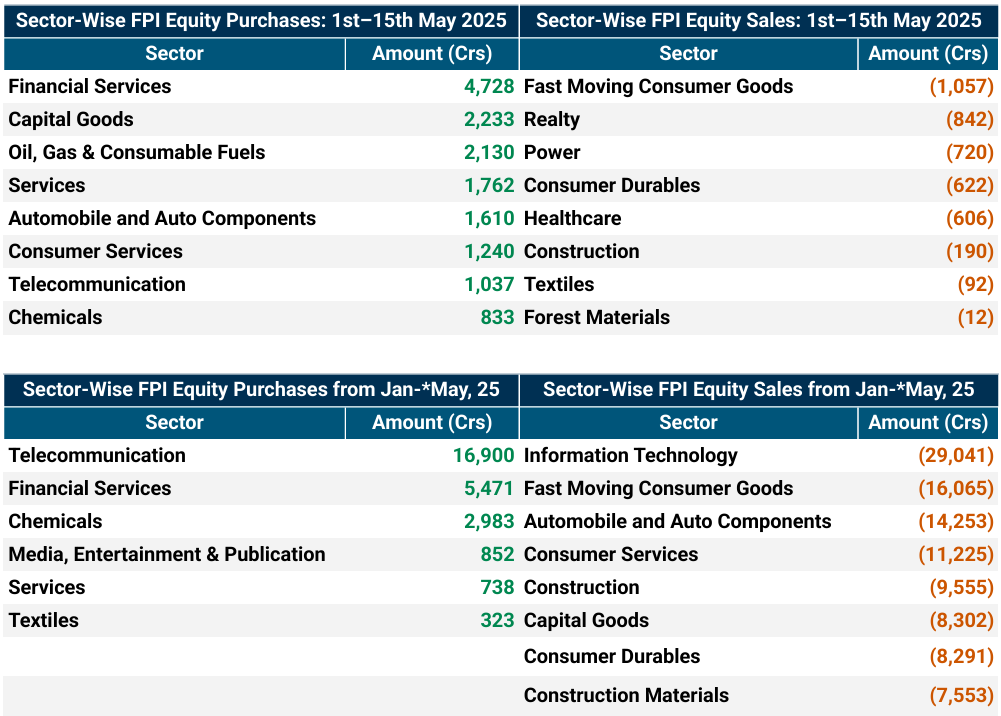

FPI Bets in 2025 So Far: Telecom Tops the Chart

For the calendar year till mid-May, FPIs invested nearly ₹27,267 Cr across key sectors. Telecom (₹16,900 Cr) led the inflows by a wide margin, with Financial Services (₹5,471 Cr) and Chemicals (₹2,983 Cr) following suit. Smaller but positive flows were seen in Media, Services and Textiles, reflecting niche strategic interests.

FPI Sectoral Selloff Till Now in 2025 – Tech & Consumption Drag Down Sentiment

Total FPI outflows this year touched a massive ₹1,33,958 Cr, with the biggest exits in Information Technology (₹29,041 Cr), FMCG (₹16,065 Cr) and Auto Components (₹14,253 Cr). Sizable selling also occurred in Consumer Services, Capital Goods, Durables and Construction-related sectors—marking a cautious stance in broader consumption and infra-linked bets.

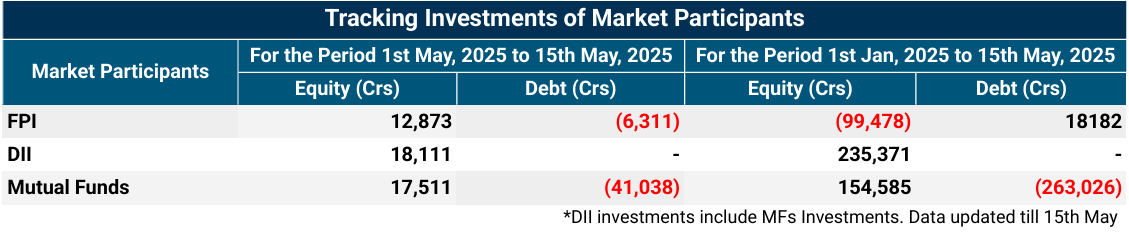

FPIs Turn Steady Buyers Since Mid-April; Debt Sees Continued Outflows

Foreign Portfolio Investors infused ₹12,873 Cr into Indian equities in the first half of May, extending their buying streak that began on April 15th. Remarkably, they have been net buyers on 20 out of 21 trading sessions, accumulating a total of ₹56,770 Cr since April 15, with strong focus on financials and capex themes.

However, the debt segment witnessed an outflow of ₹6,311 Cr, likely due to rising U.S. bond yields and profit-booking in Indian fixed income instruments.

DII Support Stays Strong – Relentless Equity Buying Continues

Domestic Institutional Investors remained strong market anchors, investing ₹18,111 Cr in equities in just the first half of May. Their YTD equity inflows have surged to ₹2.35 lakh Cr, reflecting robust SIP flows, strong retail participation and sustained domestic conviction in India’s growth story.

Mutual Funds: Equity Heavyweights

Mutual funds added ₹17,511 Cr to equities in the first 15 days of May, contributing the bulk of DII inflows. So far in 2025, mutual funds have invested ₹1.54 lakh Cr in equities, showcasing a clear shift in preference toward equity markets.

FPI AUC Rises Sharply in First Half of May 2025, Driven by Equity Gains

In the first half of May 2025, Foreign Portfolio Investors' Assets Under Custody (AUC) rose to ₹78.06 Lakh Cr, up from ₹75.72 Lakh Cr in April, marking a robust monthly increase of ₹2.34 Lakh Cr.

Equity AUC grew significantly by ₹2.38 Lakh Cr, from ₹68.94 Lakh Cr in April to ₹71.32 Lakh Cr in the first half of May, reflecting strong price appreciation and sustained buying since mid-April.

For a comprehensive understanding and more insights, please go through our detailed report.