FPIs Bet on IT, Realty, Healthcare and More - In December, FPIs invested in Information Technology, Realty, Healthcare, Consumer Services, Capital Goods, Financial Services, Services and Construction sectors, signaling a cautious yet targeted approach amid broader market uncertainties.

FPI Record Selloff Hits Key Sectors: Oil & Gas, Auto and FMCG - In November, FPIs significantly reduced holdings across crucial sectors like Oil & Gas, Automobile & Auto Components, FMCG, Power, Consumer Durables, Construction Materials and Diversified. This widespread selloff underscores rising global uncertainties and intensifying market pressures.

FPIs Top Picks in 2024: Capital Goods, Healthcare, IT and More - In 2024, FPIs have shown a clear preference for sectors like Capital Goods, Healthcare, Telecom, Consumer Services, Realty, Services, Information Technology and Chemicals, highlighting their strategic focus on these high-growth industries.

FPI Exit in 2024: Major Selloff in Financials, Oil & Gas, FMCG and More - In 2024, FPIs have heavily offloaded their holdings in sectors like Financial Services, Oil & Gas, FMCG, Construction, Automobile & Auto Components, Construction Materials, Power and Media, reflecting a broad exit from these key areas.

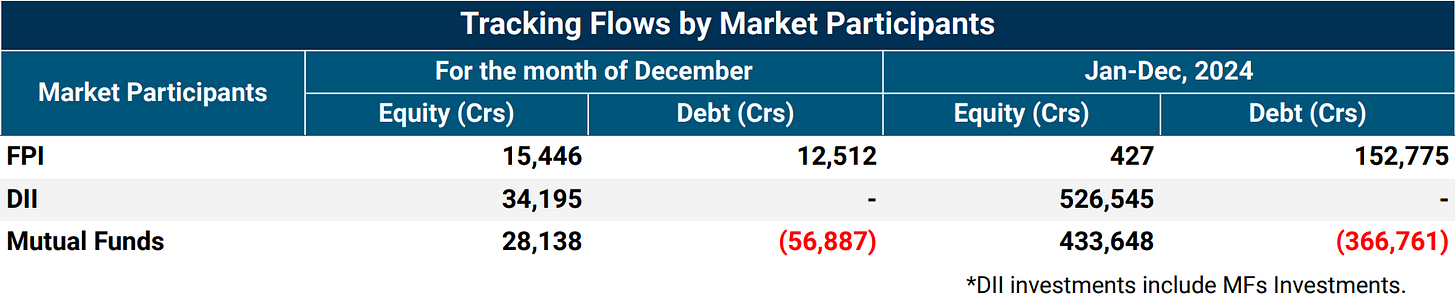

Muted FPI Activity in 2024, December Focus on Primary Market - In December 2024, FPIs invested ₹18,036 Cr in the primary market, marking continued interest in IPOs and QIPs. However, they sold ₹2,590 Cr worth of equities in the secondary market, resulting in a net investment of ₹15,446 Cr for the month.

FPIs Chase IPO Boom, Exit Secondary Markets in 2024 - FPIs invested a record ₹1.22 Lakh Cr in IPOs and QIPs, the highest ever, according to NSDL data. However, they pulled out ₹1.21 Lakh Cr from the secondary market, resulting in a modest net inflow of ₹427 Cr for the year 2024.

FPIs Spark Record-Breaking Debt Market Investment in 2024 - FPIs poured ₹12,512 Cr into the Indian debt market in December. Cumulative FPI debt investment surged to ₹1,52,775 Cr, marking an all-time high for Indian debt markets. This milestone surpasses the previous record of ₹1,48,808 Cr set in 2017.

DIIs Provide Market Cushion with ₹34,195 Cr Investment in December - Domestic Institutional Investors (DIIs) set a record in 2024 with net purchases exceeding ₹5.26 trillion, breaking the ₹2.8 trillion annual investment record from 2022.

Mutual Funds' Record-Breaking ₹4.34 Trillion Investment in 2024 - Mutual Funds led the charge in record-breaking DII investment, contributing ₹4.34 trillion out of the ₹5.26 trillion total in 2024. In December, they bolstered the Indian equity markets with an investment of ₹28,138 Crs, cementing their role as a market stabilizer.

For a comprehensive understanding and more insights, please go through our detailed report.