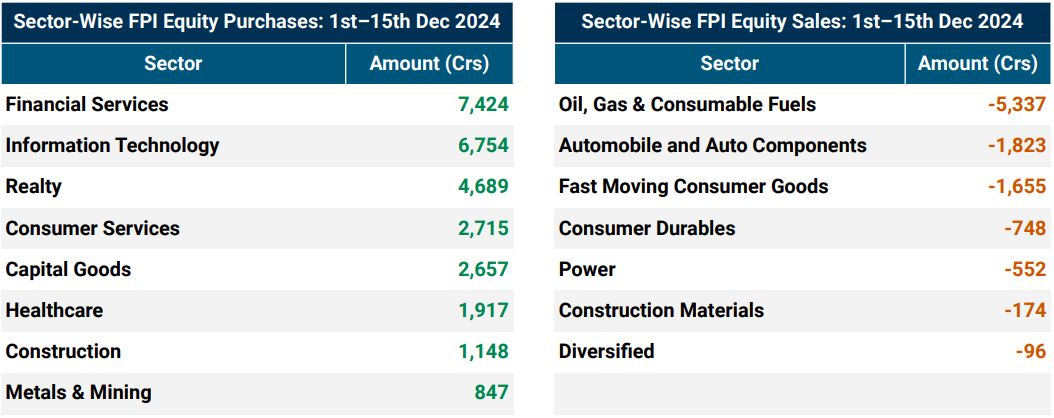

FPIs Shift to Buying Mode: Focus on Financials, IT, Realty and More - Following significant selloffs in October and November, FPIs have turned buyers in the first half of December, signaling a shift in strategy. Their investments are now focused on sectors like Financial Services, Information Technology and Realty, along with Consumer Services, Capital Goods, Healthcare, Construction and Metal & Mining.

FPIs Divest Aggressively in Oil & Gas Sector - In the first half of December, FPIs executed a significant selloff in the Oil & Gas sector, disinvesting ₹5,337 crore. Other sectors that witnessed selloffs include Automobiles & Auto Components, FMCG, Consumer Durables, Power and Construction Materials, reflecting a strategic reallocation of investments by foreign players.

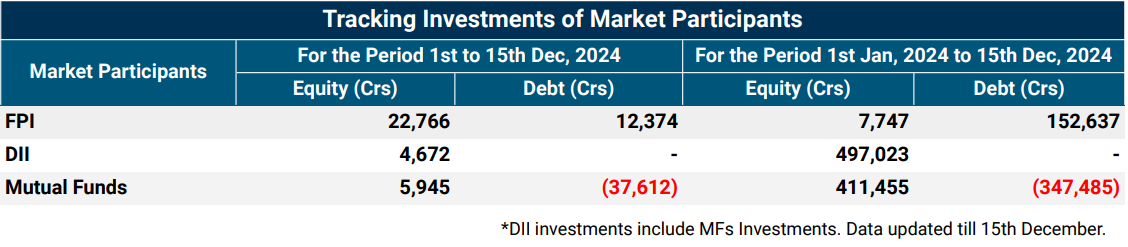

FPIs Back with a Bang: ₹22,766 Cr Pours into Indian Equities in December’s First Half

FPIs shifted gears in December, becoming net buyers after October and November sell-off.

Equity purchases through secondary markets hit ₹14,435 Cr in the first half of December, sparking a recovery from November lows.

Total FPI investment, including primary market investments and others, surged to ₹22,766 Cr.

FPIs Spark Record-Breaking Debt Market Investment in 2024

FPIs poured ₹12,374 Cr into the Indian debt market in the first half of December.

Cumulative FPI debt investment surged to ₹1,52,637 Cr, marking an all-time high for Indian debt markets. This milestone surpasses the previous record of ₹1,48,808 Cr set in 2017.

2024 is shaping up as a landmark year for FPI investments in Indian debt markets.

MFs Tap the Brakes: Slower Investment Pace in December’s First Half

Mutual Funds eased their investment momentum in the first half of December, adding ₹5,945 Cr to Indian equity markets.

In 2024, MFs have driven DII equity inflows, investing an astounding ₹4.11 trillion out of the total ₹4.97 trillion. This is more than double the ₹1.86 trillion invested in 2022, showcasing their rising dominance.

DIIs Shift Gears: Profit Booking Amid Record Annual Investments

DIIs, excluding Mutual Funds, turned sellers in early December, booking profits with over ₹1,000 Cr in Indian equity markets.

Despite this, DIIs have net bought a record ₹4.97 trillion in 2024, shattering the previous high of ₹2.8 trillion in 2022.

FPIs Top Picks in 2024: Capital Goods, Healthcare, Telecom and More - In 2024, FPIs have shown a clear preference for sectors like Capital Goods, Healthcare, Telecommunication, Consumer Services, Realty, Information Technology, Services and Chemicals. This strategic focus underscores their confidence in high-growth industries.

FPI Exit in 2024: Major Selloff in Financials, Oil & Gas, FMCG, Auto and More - In 2024, FPIs have heavily offloaded their holdings in sectors like Financial Services, Oil & Gas, FMCG, Automobile & Auto Components, Construction, Construction Materials, Power and Media, reflecting a broad exit from these key areas.

For a comprehensive understanding and more insights, please go through our detailed report.