CY2025 Performance Wrap: Metals Ruled, Global Equities Surged, Rupee Under Pressure

Financial Report

What stood out in CY2025

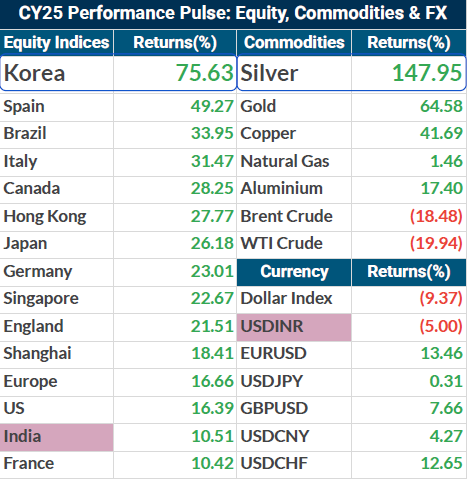

Metals stole the show: Commodities led the year, with Silver up ~148% and Gold up ~65%, supported by Fed-cut expectations, ETF/central-bank demand, supply tightness and geopolitical hedging.

Global equities: strong upside, uneven leadership: Korea (+75.63%) topped the charts, followed by Spain (+49.27%) and Brazil (+33.95%). Developed markets stayed broadly positive, while India (+10.51%) remained in the green but trailed most peers.

India equities: green year, narrow rally: Frontline indices held up (Nifty 50 +10.51%, Sensex +9.06%), but broader participation weakened (Smallcap 250 −6.01%), reinforcing a quality-led, selective market.

Oil under pressure: Crude declined ~18%–20% (Brent/WTI), as oversupply concerns outweighed intermittent geopolitical spikes.

The report also includes sector leadership (PSU Banks/Metals/Auto), major stock leaders & laggards, and a mutual fund performers snapshot (equity, hybrid and index funds).

For a comprehensive understanding and more detailed insights, please refer to our full report.