April’s Investment Pulse: Changing Hands Across Asset Classes

April saw a dramatic shift in sentiment among key market players, with sharp contrasts between the first and second halves of the month. While FPIs made a strong comeback in equities after a steep early exit, mutual funds turned cautious and DIIs remained steady with their buying spree.

Sector Shuffle: FPIs Rotate Aggressively Across Sectors in April

April 2025 witnessed a sharp shift in Foreign Portfolio Investors (FPI) equity allocation, with a clear preference for domestic-facing and policy-driven sectors while exiting global and tech-heavy names.

Sectors That Attracted FPI Flows

Financial Services saw a massive comeback, with FPIs reversing ₹4,501 Cr outflows in the first half with a whopping ₹22,910 Cr inflow in the second half, ending April with ₹18,409 Cr — the highest among all sectors.

Telecom attracted ₹4,648 Cr, driven by digital growth themes.

FMCG and Consumer Services also gained favor, pulling in ₹2,917 Cr and ₹1,797 Cr respectively, with strong momentum in the second half.

Sectors Facing the Heat

IT faced the steepest selloff, with FPIs pulling out ₹15,213 Cr amid global tech weakness and earnings concerns.

Metals & Mining (₹3,403 Cr), Automobiles (₹3,207 Cr) and Construction (₹2,886 Cr) also saw heavy FPI exits, hinting at profit booking or global demand worries.

While Oil & Gas witnessed ₹2,759 Cr selling in first half of April, it bounced back with ₹2,401 Cr inflow in second half, narrowing net outflows to ₹358 Cr.

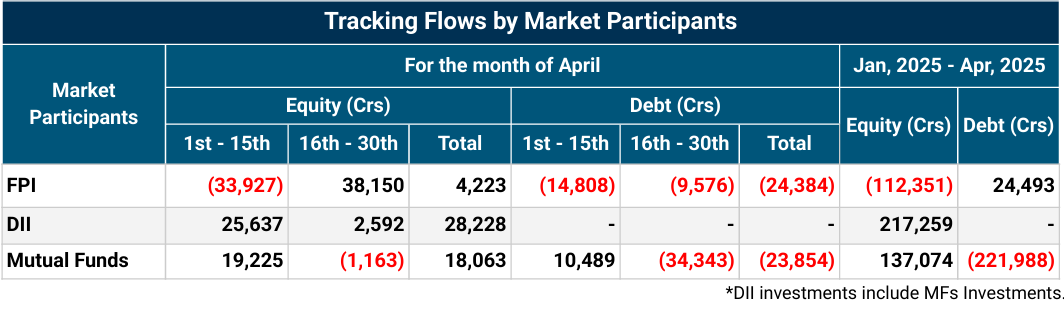

FPI: Wild Swings in Equities, Bearish on Debt

FPI U-Turn: Foreign Portfolio Investors (FPIs) made a dramatic equity turnaround in April. After withdrawing ₹33,927 Cr in the first half, they turned net buyers with ₹38,150 Cr in the second half — ending the month with a marginal ₹4,223 Cr equity inflow.

FPIs Dump Debt Amid Caution: FPIs remained consistent sellers in debt, pulling out ₹24,384 Cr in April, led by both halves, indicating continued risk aversion or profit-booking in the fixed income space.

DIIs: Steady and Resilient: Domestic Institutional Investors (DIIs) stayed consistently bullish on Indian equities. They poured in ₹25,637 Cr during the first half and ₹2,592 Cr in the second, totaling ₹28,228 Cr in April — underscoring continued confidence despite global volatility.

Mutual Funds: From Aggressive to Defensive: Mutual Funds Shift Gears Mid-April Mutual Funds reversed their strategy mid-month. After an aggressive ₹19,225 Cr equity infusion in the first half, they booked profits worth ₹1,163 Cr in the second half.

April 2025 FPI Snapshot: Steady Equity Rise, Subtle Shift in Debt Preferences

Foreign Portfolio Investors (FPIs) increased their overall Indian exposure in April 2025, taking total investments to ₹75.72 Lakh Cr, up from ₹73.76 Lakh Cr in March. The incremental rise of nearly ₹1.96 Lakh Cr highlights a continued commitment to Indian markets, though with nuanced shifts across asset classes.

Equity Holdings climbed to ₹68.94 Lakh Cr, gaining over ₹86K Cr from March. This reflects the return of FPI confidence in Indian equities — aligned with the sharp second-half equity buying seen across financials, telecom and consumption sectors.

Debt General saw a mild pullback, dropping from ₹1.82 Lakh Cr to ₹1.70 Lakh Cr, indicating risk-off sentiment in traditional debt instruments.

For a comprehensive understanding and more insights, please go through our detailed report.