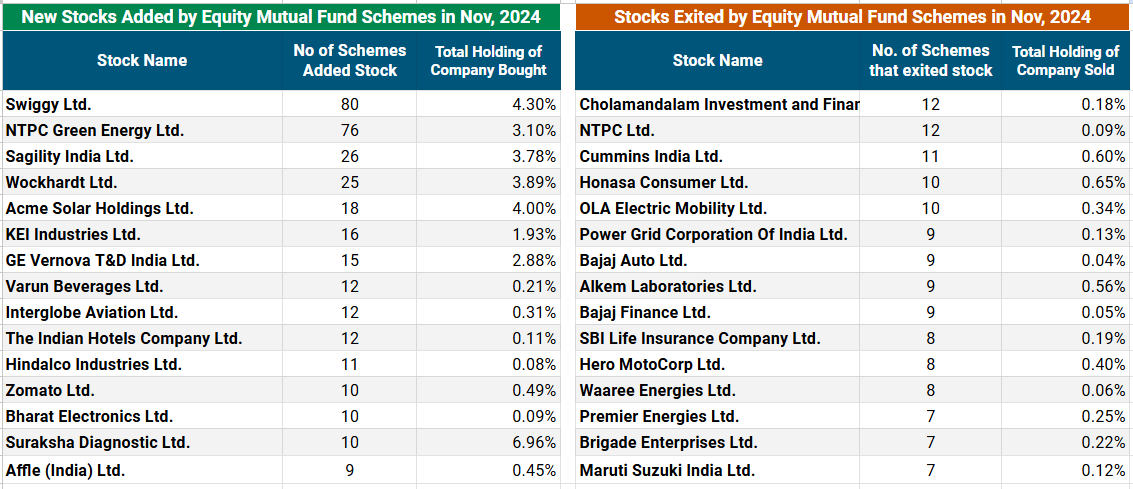

Equity MFs Target High-Potential IPOs in November: More than 75 equity mutual fund schemes actively participated in November's standout IPOs, including Swiggy and NTPC Green Energy. Other notable offerings, such as Sagility India, Acme Solar Holdings and Suraksha Diagnostic Ltd, also attracted significant investments. This trend highlights fund managers' strategic focus on high-potential market entrants to drive portfolio growth.

Top New Investment Picks by Equity Mutual Funds: Several equity mutual fund schemes have demonstrated a strong preference for fresh investments in companies such as Wockhardt, KEI Industries, Zomato, Varun Beverages, Interglobe Aviation, Affle India, Hindalco Industries and Bharat Electronics.

Equity Schemes Exit Key Positions in Major Companies: Several equity schemes have fully exited their positions in companies such as Cholamandalam Investment & Finance, NTPC, Cummins India, Honasa Consumer, Ola Electric Mobility, Power Grid, Bajaj Auto, Alkem Laboratories, Hero Motocorp, Premier Energies, Brigade Enterprises and Waaree Energies.

Mid-Cap Moves: Among the top-traded mid-cap stocks, many schemes invested in companies such as KEI Industries and Lupin. Meanwhile, several equity schemes chose to sell holdings in Coforge, Voltas, The Indian Hotels Company, FSN E-Commerce(NYKAA), Info Edge, Fortis Healthcare, Oberoi Realty and Mphasis.

Small-Cap Shifts: Among the most actively traded small-cap stocks, various equity schemes directed their investments towards companies such as Wockhardt, Medplus Health Services, Welspun Corp, PNB Housing Finance, Timken India and Aster DM Healthcare, while notable disinvestment occurred in MCX, Radico Khaitan and Aditya Birla Real Estate.

November Marks All-Category Inflow Milestone for Equity Funds: For the second consecutive month this calendar year, all categories of equity funds reported positive net inflows in November. This trend underscores sustained and broad-based investor interest across the equity segment.

Sector/Thematic Funds Inflows Slowed Down but Dominate 2024: In November, the inflow trend for Sector/Thematic Funds slowed for the first time, with ₹7,658 Crs accounting for 21.30% of monthly inflows. Despite this, overall equity mutual funds saw strong inflows of ₹3.53 Lakh Crs this year, with Sector/Thematic Funds capturing an impressive 40% of the total, showcasing their dominance in 2024.

For a comprehensive understanding and more insights, please go through our detailed report.