January 2025 Equity MFs Insights: Market Jitters, SIP Resilience & Inflow Trends

January Kickoff: Equity Mutual Funds Face a Dip: Equity mutual funds took a hit at the start of 2025, with Net Assets Under Management (AUM) slipping 3.62% to ₹29.47 Lakh Cr. The decline was fueled by a correction in Mid Cap and Small Cap stocks, dampening investor sentiment.

Mutual Funds Double Down on High-Conviction Stocks: Equity mutual fund schemes are doubling down on fresh investments in high-potential stocks, showing a strong preference for companies like Adani Wilmar, Bajaj Finance, BSE, Maruti Suzuki, Trent, Apollo Hospitals, Grasim Industries, Kotak Mahindra Bank, M&M, Navin Fluorine, SRF, Cholamandalam Investment & Finance and Indus Towers. Adding to their aggressive stance, 23 equity mutual funds have also participated in the Laxmi Dental IPO, signaling confidence in new opportunities.

Equity Schemes Exit Key Positions in Major Companies: Several equity schemes have completely offloaded their holdings in companies like Waaree Energies, HCL Technologies, Kalyan Jewellers, Jindal Steel & Power, Dabur India, CDSL, Sona BLW Precision Forgings, Hyundai Motor India, Bajaj Housing Finance, Voltas, Motilal Oswal Financial Services, Hindalco Industries and Netweb Technologies India, signaling a shift in investment strategy.

Equity Mutual Funds Accumulate in Market Leaders, Trim Positions in Select Stocks: Equity mutual fund schemes have been actively accumulating shares in top-tier companies like Axis Bank, M&M, Infosys, Zomato, HDFC Bank, Bajaj Finance, Maruti Suzuki, InterGlobe Aviation, Adani Wilmar, Persistent Systems, L&T, Dixon Technologies, Hindustan Unilever, Kotak Mahindra Bank and Bharti Airtel—reflecting strong confidence in these market leaders. Meanwhile, ITC and State Bank of India witnessed notable selloffs, signaling a shift in fund strategies.

Mutual Funds Boost Mid-Cap Bets, Trim Coforge & Indian Hotels: Among the top-traded mid-cap stocks, equity mutual fund schemes actively invested in Adani Wilmar, Dixon Technologies, Persistent Systems, Indraprastha Gas, IndusInd Bank, Max Healthcare, ICICI Lombard and Bharat Forge, signaling confidence in these stocks. On the flip side, some schemes opted to pare down holdings in Coforge and The Indian Hotels, indicating a strategic portfolio reshuffle.

Small-Cap Shifts: Among the most actively traded small-cap stocks, equity mutual fund schemes showed strong buying interest in Sudarshan Chemical Industries, CAMS, Navin Fluorine, Cyient, Happy Forgings, Sobha, Deepak Fertilizers and MCX. However, notable selloffs were witnessed in Apollo Tyres and Motherson Sumi Wiring India, reflecting a strategic portfolio shift.

Sector/Thematic Funds Reign Supreme in Equity MFs for the 7th Straight Month: Kicking off 2025 with dominance, Sector/Thematic Funds retained their top spot in the Equity Mutual Fund segment for the seventh consecutive month, boasting a Net AUM of ₹4.61 Lakh Cr. Close on their heels, Flexi Cap Funds followed with ₹4.29 Lakh Cr, reflecting sustained investor preference for targeted investment themes.

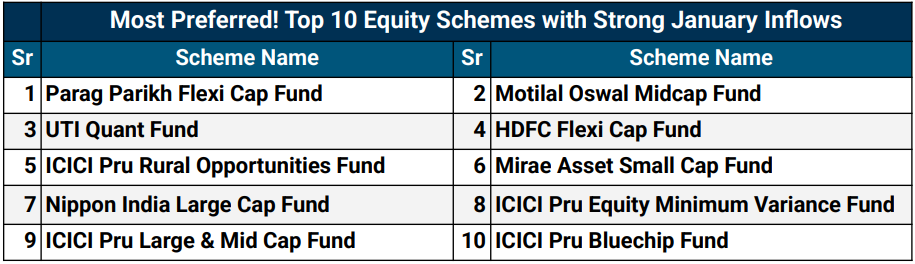

ICICI Prudential Mutual Fund Leads January Equity Inflows: ICICI Prudential Mutual Fund emerged as the top gainer in open-ended equity schemes (excluding ETFs & Index Funds), commanding over 15% of total equity inflows in January. The dominance extended further as ICICI Pru, HDFC, Motilal Oswal, Nippon, SBI, PPFAS and Kotak AMCs collectively secured over 60% of the month’s inflows.

For a comprehensive understanding and more insights, please go through our detailed report.