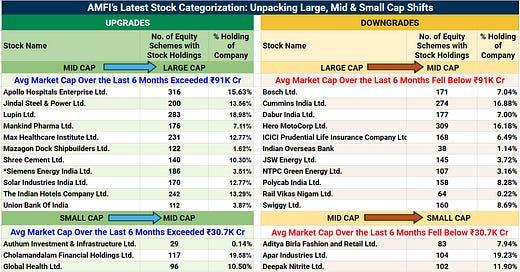

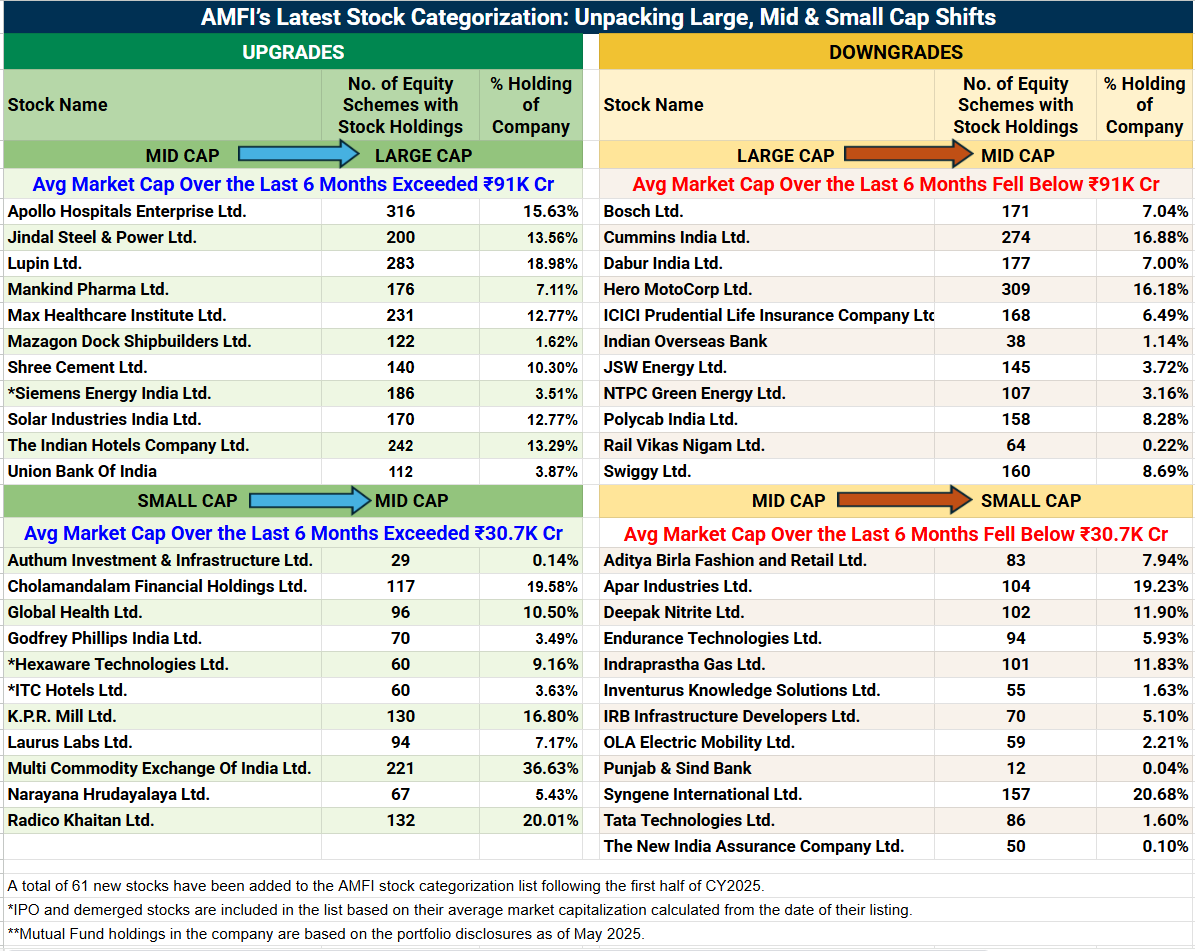

Market Cap Cutoffs Fall in Latest Stock Categorization :- In the recent stock categorization, the Large Cap cutoff for average market capital over last 6 months has declined to ₹91,500 Cr from ₹1 Lakh Cr. Similarly, the Mid Cap cutoff for average market capital over last 6 months has decreased to ₹30,700 Cr from ₹33,000 Cr, as observed in the first half of calendar year 2025.

AMFI’s Latest: 11 Stocks Elevated to Large Cap :- In the latest AMFI stock categorization, ten stocks have been upgraded from Mid Cap to Large Cap, including Apollo Hospitals, Jindal Steel & Power, Lupin, Max Healthcare, Mazagon Dock, Shree Cement, Solar Industries, Indian Hotels Co. and Union Bank of India. Siemens Energy India, a demerged entity, has also been newly added to the Large Cap category based on market capitalization.

Falling Market Cap Cutoffs Highlight Sluggish Market Momentum in Early 2025:- The drop in Large and Mid Cap cutoffs in AMFI’s latest categorization stems from a market cool-off in Jan–Jun 2025 after a strong rally in late 2024. Early 2025 was impacted by profit booking, cautious post-election sentiment and global headwinds including renewed geopolitical tensions, inflation concerns and delays in US Fed rate cuts. However, the high base of H2CY24 made it challenging for markets to sustain momentum. Adding to the pressure was the escalation of trade tariff tensions under Donald Trump’s new administration, which triggered risk-off sentiment among global investors. FII outflows and rotation away from overvalued mid and small caps into safer assets further compressed average market caps, resulting in lowered categorization cutoffs.

Key Downgrades: 11 Stocks Move from Large Cap to Mid Cap :- On the flip side, eleven stocks have been downgraded from the Large Cap to the Mid Cap category. This list includes Bosch, Cummins India, Dabur, Hero MotoCorp, ICICI Prudential Life Insurance, Indian Overseas Bank, JSW Energy, NTPC Green Energy, Polycab, Rail Vikas Nigam and Swiggy.

Small to Mid Cap Upgrades Gain Momentum:- In the latest AMFI stock categorization, nine stocks have been upgraded from Small Cap to Mid Cap after their average market capitalization over the last 6 months exceeded ₹30,700 crore. This list includes Authum Investment & Infrastructure, Cholamandalam Financial Holdings, Global Health, Godfrey Phillips India, K.P.R. Mill, Laurus Labs, MCX, Narayana Hrudayalaya and Radico Khaitan. Additionally, demerged entity ITC Hotels and IPO stock Hexaware Technologies have been newly added to the Mid Cap list.

Mid to Small Cap Downgrades Reflect Market Pressure:- Meanwhile, twelve stocks were downgraded from Mid Cap to Small Cap as their 6-month average market capitalization fell below ₹30,700 crore. This includes Aditya Birla Fashion, Apar Industries, Deepak Nitrite, Endurance Technologies, Indraprastha Gas, Inventurus Knowledge Solutions, IRB Infra, OLA Electric Mobility, Punjab & Sind Bank, Syngene International, Tata Technologies and The New India Assurance Company.

Fresh Entrants: 61 New Stocks Join AMFI Categorization in H1CY2025:- Net 61 new stocks have been added to the AMFI stock categorization list in the first half of calendar year 2025.

For a comprehensive understanding and more insights, please go through our detailed report.